Are you a student wondering when your next student finance payment is due? The payment schedule for student finance can be confusing, as it is based on the tax year rather than the academic year. However, understanding the payment dates is crucial for budgeting and planning your finances throughout the academic year.

Student finance payments are made in equal instalments throughout the year, with exact dates determined by the start date of your course and working days. As a full-time undergraduate student, you can expect to receive three payments per year. But where do you find information about these payment dates? And how do you ensure that your loans are extended for the entire duration of your course?

Maximum Student Maintenance Loan, Eligibility, and How Much You Could Get

How much maintenance loan will you get?

Most students are eligible for a maintenance loan to help with living costs while studying. The maximum maintenance loan available for students in England is £9,488 per year, while students in Wales can receive up to £10,124 per year. However, the actual amount you receive depends on several factors, such as your household income and location.

You can use the student finance calculator on the government website to determine how much maintenance loan you’re eligible for. This tool considers your course intensity (full-time or part-time), where you’ll study and live, and your household income.

What to do if your maintenance loan isn’t enough?

If the amount of maintenance loan you receive isn’t enough to cover all your living expenses while studying, there are other options available:

- Apply for additional grants: Students from households with an income below the salary threshold may be eligible for other donations to help with living costs.

- Consider part-time work: Many students work part-time alongside their studies to supplement their income.

- Look into scholarships or bursaries: Some universities offer scholarships or bursaries that can help cover living expenses.

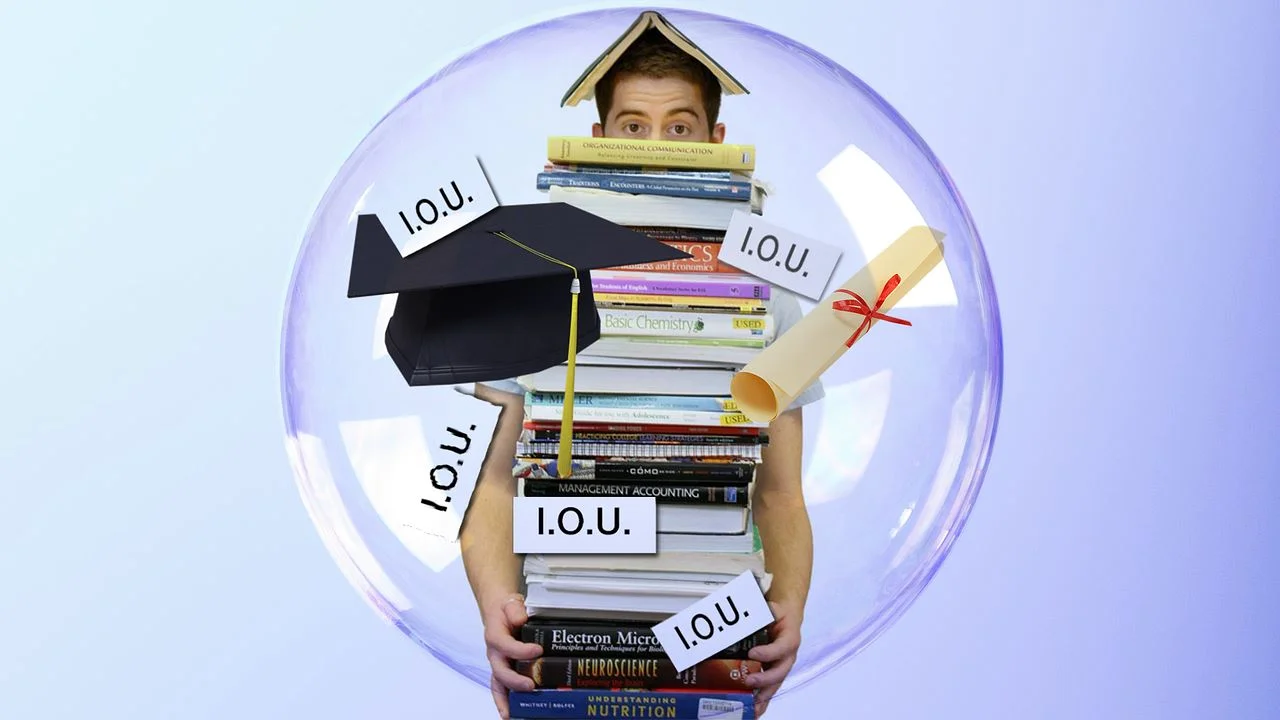

It’s important to remember that taking out a student loan is a big financial commitment. Before deciding to finance your studies, consider all options carefully and seek advice if necessary.

How much could I get?

The maximum amount of maintenance loan available varies depending on where you live and study in the UK. Here’s a breakdown of the maximum amounts available:

- England: Up to £9,488 per year

- Wales: Up to £10,124 per year

- Scotland: Up to £7,750 per year

- Northern Ireland: Up to £8,203 per year

However, these amounts are only available to students who meet the eligibility criteria.

Minimum and Maximum Maintenance Loans in England

What are maintenance loans?

Maintenance loans are financial assistance the government provides to help students in England with their living costs while studying. The amount of loan a student can receive depends on their household income, where they live while looking, and whether they are studying full-time or part-time.

Minimum maintenance loan

The minimum amount of maintenance loan available for students living at home is £3,410 per year. If you live with your parents or guardians while studying, you can receive up to this amount to cover your living expenses.

Maximum maintenance loan for London students

If you decide to study in London and live away from home, you can receive up to £12,010 per year as a maximum maintenance loan. Living costs in London tend to be higher than in other parts of the country; therefore, the government provides more financial support.

Maximum maintenance loan for non-London students

The maximum maintenance loan available for students living away from home outside of London is £9,203 per year. This amount is lower than the maximum available for London students due to the difference in living costs between these two areas.

How is the amount determined?

The exact amount of maintenance loan a student receives varies depending on several factors:

- Household income: Students from lower-income households may be eligible for more significant financial support.

- Location: As mentioned earlier, students studying in different parts of England may receive varying amounts based on differences in living costs.

- Course intensity: Full-time students typically receive more significant amounts than part-time students since they have more substantial expenses.

- Yearly tuition fees: Depending on how much tuition fees cost each academic year, there may be variations in how much financial support a student receives.

University Tuition Fees and Calculation of Maintenance Loan

University tuition fees vary depending on the course and institution.

They can vary greatly depending on the course and institution. On average, tuition fees for undergraduate courses in the UK range from £9,000 to £9,250 per year. However, some procedures, such as medicine or dentistry, may have higher fees. Understanding the costs involved is essential to research your desired course and institution thoroughly.

Tuition fee loans are available to cover the total cost of tuition fees.

To help cover the cost of tuition fees, students can apply for a tuition fee loan through the Student Loans Company (SLC). This loan covers the total tuition fees and is paid directly to your university. The amount you can borrow depends on your course and institution but generally covers up to £9,250 per year.

Maintenance loan payments are calculated based on income details and living costs.

In addition to tuition fee loans, students can apply for maintenance loans to help with living costs while at university. The amount you can borrow depends on various factors such as household income, where you live during term time, and whether you study in London or outside London. To calculate how much maintenance loan you are eligible for, you must provide income details through your student finance application.

Students may be eligible for maintenance grants, discounts, and other financial support.

Aside from loans, other forms of financial support are available for students. For example:

- Maintenance grants: These do not need to be repaid and are awarded based on household income.

- Bursaries: These are awarded by universities based on various criteria such as academic achievement or financial need.

- Scholarships: These are also awarded by universities or external organizations based on criteria such as academic merit or personal circumstances.

- Student discounts: Many retailers offer discounts specifically for students, such as discounted travel tickets or reduced prices on technology products.

Plan Two vs Plan One: Which Student Loan Plan Am I On?

Understanding the Different Types of Student Loan Plans

Knowing which type of loan plan you are on is essential. There are two types of student loan plans in the UK: Plan One and Plan Two. The kind of plan that you have depends on when you start your course.

Plan One is for students who started their course before September 1, 2012. You will be on Plan Two if you start your course after this date.

How Your Loan Package is Affected by Your Plan Type

The type of plan you are on can affect the amount of loan package you receive from the government. For example, with Plan One, the maximum tuition fee loan available is £9,250 per year for students studying in England. However, with Plan Two, the full tuition fee loan is up to £9,488 per year.

In addition to this difference in tuition fee loans between both plans, there are differences in how much maintenance loans students can receive. With Plan One, the maximum maintenance loan available for students living away from home outside London is £7,987 per year; with Plan Two, it’s up to £9,203 per year.

What Else You Need to Know About Your Loan Plan

It’s worth noting that if your parent’s income exceeds a certain threshold (currently set at £25k), the maintenance loan you can receive may be reduced under both plans.

Another key difference between both plans is how much interest accrues on your loans while you’re still studying. With Plan One loans, the interest rate is currently set at 1.5% plus RPI (Retail Price Index); with Plan Two, it’s presently set at RPI plus 3%.

It’s essential to understand your student finance payment dates and which plan you are on to plan your finances accordingly.

First Student Finance Payment Dates: When Will You Get Paid?

One of the biggest concerns for students is when they will receive their first student finance payment. The answer to this question depends on several factors, including where you live in the UK, the grant package you receive, and your term start date.

First Payment Dates for Welsh Students You can expect your first student finance payment in January. This is because the application process for student finance in Wales opens later than in other parts of the UK. However, it’s important to note that if you apply late or miss any deadlines, your payment may be delayed further.

First Payment Dates for Scottish Students

Scottish students are lucky to receive their first payment within the first few days of term. If your tour starts in September, you’ll receive your first payment at the beginning of September. However, like with Welsh students, late applications or missed deadlines could result in a delay.

Grant Package and Term Start Date Affect Your Payment Date

Your grant package will also affect when you get your first payment. Some students may receive their payments as early as August, while others will see money in April or September. If your term starts earlier than usual (for example, some universities have a “pre-term” week), this could also impact when you get paid.

It’s important to remember that once your application has been approved and processed by Student Finance England/Wales/Scotland/Northern Ireland (depending on where you live), payments can take up to six weeks to arrive in your bank account.

What Happens If You Run Out Of Money Before Your Next Payment?

If you find yourself running out of money before your next scheduled payment, don’t panic.

How to View Your Student Finance Payment Schedule and Status

Regularly Check Your Student Finance Account

One of the most important things you can do to stay on top of your student finance payment schedule is to check your account regularly. By doing so, you can ensure that any changes or updates are reflected in your account, and you can be aware of any potential issues before they become a problem.

View Your Payment Status Online

To view your payment status, log into your student finance account online. Once logged in, you can see when payments are due and whether they have been processed. This information is updated regularly, so checking back often is essential.

Use the Government Website to Access Your Account

The government website is the best place to access your student finance account. You can find all the information you need about your payments, including when they are due and how much you will receive. You can also update your details and change your account if required.

Keep Track of Your Payment Schedule

It’s essential to keep track of when your payments are due. You want to make all payments and be on time with one, which could affect future payments or even result in penalties. Make sure you know when each payment is due and set reminders for yourself if necessary.

Stay Informed About Any Changes to Your Status

If any changes to your status could affect your student finance payments, you must stay informed about them. For example, dropping out of university or changing courses mid-year could impact how much money you receive from student finance. Ensure that any changes are reported promptly to be reflected in your account.

Checking Confirmation of Registration with Student Finance

Received Confirmation of Registration from Student Finance

If you have received confirmation of registration from Student Finance, congratulations! You are one step closer to receiving your student finance payment. However, monitoring your account and ensuring everything is in order is still essential.

Awaiting Confirmation from Student Finance

If you are still awaiting registration confirmation from Student Finance, do not panic. There may be a delay for various reasons, such as incorrect enrolment or registration details. Double-check that all the information you have provided is accurate and up-to-date.

Enrolment and Registration Details

Ensure that your enrolment and registration details match what you provided to Student Finance. If there are any discrepancies, contact your university or college immediately to correct them. This will help avoid any delays in receiving your student finance payment.

National Insurance Number Accuracy

Ensure your National Insurance Number (NIN) is accurate and up-to-date. Your NIN is a unique identifier the government uses for tax purposes and must match the one on file with HM Revenue & Customs. If there are any errors in your NIN, contact HMRC immediately to get it corrected.

Providing More Evidence

Student Finance may require additional evidence before processing your application. This could include proof of identity, income or residency status. Ensure you promptly provide all requested documentation to avoid delays in receiving your student finance payment.

Repaying Your Student Loan: How and When to Start Repayment

Understanding Student Loan Repayments

Student loan repayments can be daunting but don’t have to be. It’s important to know that you will start repaying your student loan once you’ve finished your course and started earning over a certain amount. This threshold is currently set at £27,295 per year or £2,274 per month before tax.

Once you’ve started earning above this threshold, your repayment schedule will depend on how much you make each year. The rate at which you pay back your loan will increase as your salary increases too.

Starting Repayment

If employed full-time, your employer will automatically deduct the correct monthly amount from your salary. You don’t need to do anything else – it’s all taken care of for you.

If you’re self-employed or earning below the repayment threshold, then there’s no need to make any payments. However, that’s always an option if you want to start making voluntary repayments.

Payment Dates

Loan payments are usually taken on the same day each month. The exact date will depend on when you first took out your loan and what type of loan it is. For example, if you took out a maintenance loan and a tuition fee loan, these may have different payment dates.

It’s important to note that payments are still due even if you have not received a statement or reminder about payment dates from the Student Loans Company (SLC). Keep track of when payments are scheduled so you can meet all deadlines.

Parental Contributions

If your parents contributed towards your student finance while studying, this wouldn’t affect when or how much you repay after graduation. Your student finance repayment schedule is based solely on how much income you earn.

Impact of Withdrawing or Suspending from Your Course on Student Finance Payments

Overview

As a student, you may face situations that require you to withdraw or suspend your studies. However, it is essential to note that such actions can affect your student finance payments. This article will discuss the impact of withdrawing or suspending from your course on your student finance payments.

Scottish and Northern Irish Students

Scottish and Northern Irish students receive their student finance payments in instalments. These instalments are usually paid at the start of each term, with the rest made after graduation. If you withdraw or suspend your course before completing a time, you may receive only part of the payment for that term.

Other Deductions

Apart from not receiving total payments for vague terms, other deductions may be made from your student finance payments for various reasons. For instance, if you have been overpaid previously, the amount owed will be deducted from future payments until fully repaid. Similarly, changes in your circumstances, such as income or marital status, may also affect how much money you receive.

Who Qualifies for Student Loan Payment Pause?

Suppose you face financial difficulties and cannot repay your student loans due to unforeseen circumstances such as job loss or illness. In that case, you may qualify for a payment pause. During this time, repayments will only be required once you can resume making them again.

Can You Still Apply for Funding? Applying for Hardship Funds

University and college students can receive funding to help them cover their education costs. However, some students may need help financially despite receiving regular student finance payments. In these situations, applying for hardship funds can provide extra funding to help alleviate financial burdens.

Eligibility for Hardship Funds

Eligibility for hardship funds is determined by the funding body and may vary depending on household income thresholds. Students experiencing financial difficulties due to unforeseen circumstances such as illness or family problems may be eligible to apply for a grant from their university or college’s hardship fund.

Application Process

Students can find more information about hardship fund applications and grants through their university or college. The application process typically involves filling out an application form detailing the specific financial difficulties and any supporting documentation, such as bank statements or medical certificates.

Receiving Extra Funding

If a student’s application is successful, they may receive extra funding in addition to their regular student finance payments. This additional funding can help cover rent, food, and transportation costs.

Conclusion: Using Your Interest-Free Overdraft and Managing Finances

Managing your finances as a student can be challenging, but resources are available to help you make the most of your money. One such resource is an interest-free overdraft, which can provide a safety net when unexpected expenses arise. It’s important to remember that this is still borrowed money and should be used responsibly.

In addition to utilizing an overdraft, staying on top of your student finance payment schedule and status is crucial. This will ensure you receive the funds you’re entitled to promptly and avoid unnecessary stress or financial difficulties.

It’s essential to understand the process and when repayment begins. Withdrawing or suspending your course can also impact your student finance payments, so it’s vital to be aware of the consequences before making any decisions.

Applying for hardship funds may also be an option if you’re experiencing financial difficulties during your studies. However, it’s important to note that these funds are limited and should only be used as a last resort.

Managing your finances as a student requires careful planning and responsible borrowing. By staying informed about your options and taking advantage of available resources, you can make the most of your time at university without sacrificing financial stability.

FAQs:

Can I apply for additional funding if my circumstances change after receiving my initial student finance payment?

Yes, you may be eligible for additional funding if you experience significant changes in circumstances, such as loss of income or unexpected expenses. Contact Student Finance for more information.

What happens if I miss a payment deadline?

A payment deadline is necessary to avoid late fees or even suspension of future payments. Keep track of amount due dates and contact Student Finance if you anticipate any issues with making timely payments.

How do I know which student loan plan I am on?

To determine which student loan plan you are on, you can start by reviewing your loan documents and correspondence from your loan servicer. Look for any information that specifies the name or type of your student loan plan. Additionally, you can log in to your online account with your loan servicer and navigate to the section that displays your loan details. There, you should be able to find the name or type of your student loan plan. If you are still trying to figure it out, you can contact your loan servicer directly and ask them to confirm which student loan method you are currently on.