Balance Transfer Fee Calculator: Steps to Calculate Savings

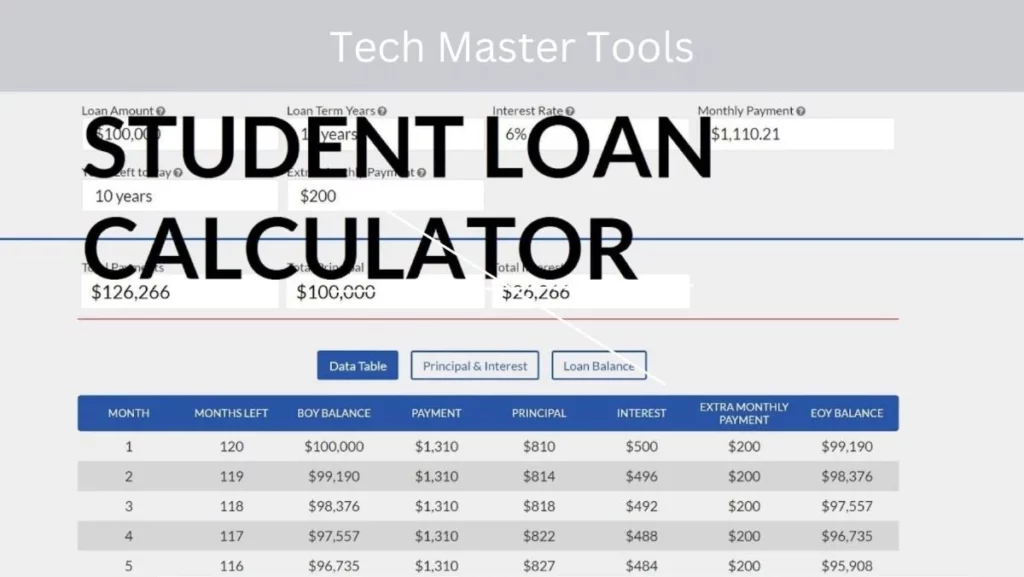

In the realm of financial management, understanding the impact of balance transfer fees from issuers on money is crucial. A balance transfer fee calculator can be a game-changer in navigating these waters efficiently. By leveraging this tool, users can assess potential savings, features, and make informed decisions about transferring balances between credit cards. This calculator […]

Balance Transfer Fee Calculator: Steps to Calculate Savings Read More »

![PSLF Reddit Tips: What Works & What Doesn't [Video]](https://blog.techmastertools.net/wp-content/uploads/2023/08/pexels-andrea-piacquadio-3808057-1-1024x616.jpg)