Are you drowning in student loan debt? Feeling overwhelmed and unsure of how to manage your finances? Look no further! Introducing the Student Loan Calculator Excel, a powerful tool that will revolutionize how you handle your loans.

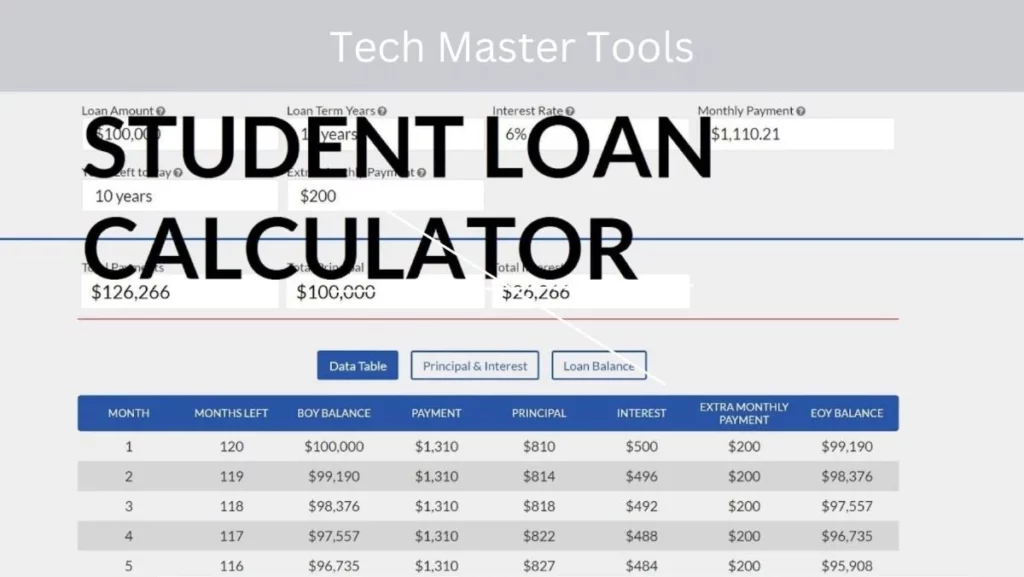

With this Excel-based calculator, you can effortlessly navigate the complex world of student loans. Say goodbye to confusing calculations and hello to financial clarity. This user-friendly tool lets you input your loan details, interest rates, and repayment options, providing instant insights into your repayment journey.

Why struggle with tedious manual calculations or rely on unreliable online calculators? The Student Loan Calculator Excel gives you complete control over your finances. Take charge today and discover the benefits of this invaluable spreadsheet. Don’t let student loans hold you back—empower yourself with the Student Loan Calculator Excel and pave the way towards a debt-free future!

Understanding Federal Poverty Guidelines:

The federal government sets income thresholds known as federal poverty guidelines. These guidelines are crucial in determining eligibility for specific student loan programs. Understanding these guidelines and how they can impact your repayment strategy is essential as a student loan borrower.

Gain insights into the income thresholds set by the federal government.

The federal poverty guidelines are updated annually and consider family size and location factors. They define the minimum income required to meet the basic needs of individuals and families. By understanding these income thresholds, you can gain insights into the financial support available to you through various student loan programs.

Understand how federal poverty guidelines impact eligibility for specific student loan programs.

Federal student loans offer different repayment options based on your income level. Some programs, such as Income-Based Repayment (IBR) or Pay As You Earn (PAYE), determine monthly payments based on a percentage of your discretionary income relative to the federal poverty guidelines. By being familiar with these guidelines, you can assess whether you qualify for these income-driven repayment plans.

Learn why it’s essential to know these guidelines when planning your loan repayment strategy.

Awareness of the federal poverty guidelines helps you make informed decisions about your student loans. It allows you to estimate your eligibility for specific repayment plans and calculate potential monthly payments accordingly. This knowledge lets you plan your budget effectively and avoid unnecessary financial strain during loan repayment.

Understanding how federal poverty guidelines affect student loans is essential in managing your finances responsibly. By staying informed about these thresholds, you can make strategic choices that align with your financial situation and goals.

Remember that eligibility criteria may vary depending on the specific program or lender, so it’s always advisable to consult official sources or speak with a financial aid advisor for accurate information tailored to your circumstances.

Remember that while federal poverty guidelines provide valuable insights into eligibility for specific programs, they are not a particular measure of financial need.

How Much Do Student Loans Cost Per Month?

Calculate Your Monthly Student Loan Payments with Excel

How much will your student loans cost you each month? Our Excel calculator can help you figure it out. You can quickly determine your monthly payment by inputting key details such as the loan amount, interest rate, and repayment term.

Understanding the Factors Affecting Your Payments

Student loan debt can feel overwhelming, but it’s essential to break it down into manageable chunks. Our calculator allows you to see how different factors impact your monthly payments. Here are some key points to consider:

- Interest Rates: The interest rate on your student loans significantly determines your monthly income. Higher rates mean more money going towards interest rather than reducing the principal balance.

- Repayment Terms: The length of your repayment term affects how much you’ll pay each month. A shorter period means higher monthly payments but less overall interest.

- Loan Amount: The total money borrowed also influences your monthly income. If you take out a larger loan, expect higher monthly payments than someone with a smaller loan amount.

Effective Budget Planning for Student Loan Repayment

Knowing the financial commitment to repay student loans is crucial for effective budget planning. Here’s why understanding the costs per month matters:

- Total Payment: By calculating your monthly payments, you can determine the total amount of money paid over the life of the loan. This information helps you evaluate whether pursuing additional education or exploring alternative financing options may be more beneficial.

- Budget Allocation: When creating a budget, allocating funds for student loan payments consistently monthly is essential. Knowing how much money needs to be set aside helps cover other expenses while staying on track with repayments.

- Salary Considerations: Understanding your future income prospects and career trajectory is vital when assessing the affordability of your monthly payments.

Weighted Average Interest Rate Calculation and Principal vs Interest: Understanding Your Loan Details

Calculate Your Average Interest Rate

Calculating the weighted average interest rate on multiple loans can be daunting. But don’t worry; our student loan calculator Excel tool is here to simplify the process for you. You can quickly determine your average interest rate by inputting the necessary information, such as the loan amounts, interest rates, and terms.

Understanding your average interest rate is crucial because it gives you a clear picture of how much you pay in interest charges across all your loans. This knowledge empowers you to make informed decisions about managing your debt effectively.

Breakdown of Principal vs Interest

When making loan payments, it’s essential to understand how much goes towards reducing your debt (principal) versus what is allocated towards interest charges. Our calculator provides an amortization schedule and divides each payment into principal and interest components.

By knowing this breakdown, you gain insight into how much progress you’re making in paying off your loans. It allows you to see if there are opportunities to increase payments towards the principal and reduce the overall interest paid over time.

Gain Clarity on Your Loan Details

Using our student loan calculator Excel tool helps clarify your loan details. You’ll have access to valuable information like:

- Total interest: The total amount of money paid in interest throughout the life of your loans.

- Interest payments: The specific amount allocated towards interest charges for each payment.

- Principal payments: The portion of each amount directly reduces your outstanding balance.

- Amortization schedule: A detailed table showing how each payment affects principal and interest over time.

With these insights, you can better strategize repayment plans or consider refinancing options that may save you money in the long run.

Remember, understanding the breakdown between principal and interest allows you to take control of your financial situation.

Select a Student Loan Repayment Plan Based on Your Financial Goals (Optional):

Explore Different Repayment Plans

You have several options available. Understanding the different repayment plans and choosing one that aligns with your financial goals is essential. Here are some key points to consider:

- Standard Repayment Plan: This is the default plan for most federal student loans. It offers fixed monthly payments over ten years.

- Income-Driven Repayment Plans: These plans adjust monthly payments based on income and family size. There are several options available, including:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

- Extended Repayment Plan: If you need more time to repay your loans, this plan extends the repayment period up to 25 years, reducing the monthly payments but increasing the overall interest paid.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase every two years over ten years.

Determine Your Objectives

Before selecting a repayment plan, it’s essential to determine your financial objectives:

- Minimizing Monthly Payments: If your priority is to keep your monthly payments as low as possible, income-driven plans like IBR or PAYE may be suitable options.

- Paying Off Debt Quickly: If you want to pay off your loan faster and save on interest in the long run, the standard or graduated repayment plans can help you achieve that goal.

- Loan Forgiveness and Borrower Protections: Some repayment programs offer loan forgiveness after several qualifying payments or provide additional borrower protections such as deferment or forbearance options.

Income-Driven Repayment Calculator and Other Student Loan Repayment Calculators: Finding the Right Plan for You

Managing Your Student Loan Payments with Income-Driven Repayment Plans

Do you need help to keep up with your student loan payments? Income-driven repayment plans can be a game-changer. These plans allow you to adjust your monthly payments based on your income level, making staying on top of your financial obligations more manageable. You can determine which plan suits you best.

An income-driven repayment plan determines the amount you owe monthly by a percentage of your discretionary income. This means that if you earn less, your monthly payment will be lower. Conversely, if you make more, your price will increase accordingly. It’s a flexible option ensuring your payments are manageable regardless of your life stage or career.

Exploring Useful Calculators for Evaluating Repayment Strategies

In addition to income-driven repayment calculators, other helpful tools are available to evaluate different student loan repayment strategies. These calculators can assist in determining the most effective approach based on factors such as interest rates, loan terms, and total debt.

Here are some valuable calculators worth exploring:

- Loan Consolidation Calculator: This calculator helps assess whether consolidating multiple loans into one is brilliant for simplifying repayments and potentially lowering interest rates.

- Standard Repayment Calculator: Use this calculator to determine how much you would pay each month under a standard repayment plan without any adjustments based on income.

- Debt Payoff Calculator: Calculate how long it will take to pay off your student loans by inputting details like current balance, interest rate, and monthly payment amount.

- Interest Savings Calculator: Find out how much money you could save over time by making extra payments towards your principal balance or refinancing at a lower interest rate.

The Avalanche Method vs Benefit-Focused Method: Which is Right for You?

Pros and Cons of the Avalanche Method and Benefit-Focused Method

It’s essential to have a strategy in place. Two popular methods that can help you tackle your debt are the Avalanche and the Benefit-Focused Method. Let’s take a closer look at the pros and cons of each.

Avalanche Method

The Avalanche Method is all about prioritizing high-interest loans first. Here’s how it works:

- Analysis: List all your student loans and their interest rates.

- Fact: Identify the loan with the highest interest rate.

- Snowball: Make minimum payments on all other loans while putting any extra money towards paying off the loan with the highest interest rate.

- Way: Once you’ve paid off that loan, move on to the one with the next highest interest rate, and so on.

Pros:

- You’ll save money in the long run by tackling high-interest loans first.

- It helps you become debt-free faster since you focus on reducing interest costs.

Cons:

- It may take longer to see progress if your high-interest loans have large balances.

- If you have multiple loans with similar interest rates, it can be challenging to decide which one to pay off first.

Benefit-Focused Method

The Benefit-Focused Method takes a different approach by prioritizing loans based on their benefits rather than their interest rates:

- Need: Determine which loan provides the most significant benefits, such as forgiveness programs or flexible repayment options.

- Many years: Focus on making minimum payments on other loans while allocating extra funds towards maximizing benefits for this specific loan.

- Way: Once you’ve maximized those benefits or paid off that loan completely, move on to another loan with valuable gifts.

Should I Refinance My Student Loan? Homeowners May Want to Refinance While Rates Are Low:

Benefits of Refinancing Student Loans

Refinancing student loans can offer significant benefits, especially for homeowners during low-interest rates. Refinancing your student loans can lower monthly payments or reduce overall interest costs. This can provide much-needed financial relief and help you achieve your long-term financial goals.

When considering whether to refinance your student loans, it’s essential to understand the advantages of this option. Here are some key benefits to keep in mind:

- Lower Interest Rates: One of the primary reasons people choose to refinance their student loans is to take advantage of lower interest rates. When market conditions are favourable, refinancing allows you to replace your existing loan with a new one at a lower rate. This can result in substantial savings over the life of your loan.

- Reduced Monthly Payments: Refinancing also allows you to secure more manageable monthly payments. Extending the repayment term or securing a lower interest rate can decrease your monthly income. This can free up cash flow and make it easier to meet other financial obligations.

- Consolidation Simplification: Refinancing allows consolidation if you have multiple student loans from different lenders. By combining all your loans into one, you simplify the repayment process and only have one monthly payment instead of several.

Using Our Excel Calculator

To determine whether refinancing is viable, consider utilizing our Excel calculator specifically designed for student loan refinancing analysis. With this tool, you can input relevant information about your current loan terms and compare them against potential refinanced options.

The Excel calculator considers current interest rates, the remaining balance on your existing loan, repayment term lengths, and any associated fees.

How to Pay Off Student Loans: Should You Pay Off Your Student Loan Early?

Evaluate the advantages and disadvantages of paying off student loans early.

Paying off your student loans early can have both advantages and disadvantages. It’s essential to consider these factors before making a decision. Here are some points to keep in mind:

- Advantages:

- Save on interest: By paying off your loan early, you can reduce the interest you’ll pay over the life of the loan. This can save you thousands of dollars.

- Financial freedom: Being debt-free sooner gives you more financial flexibility and freedom. You’ll have extra monthly money that can be used for other purposes, such as saving for a down payment on a house or investing.

- Peace of mind: Eliminating your student loan debt can provide relief and relaxation, knowing that you no longer owe money to lenders.

- Disadvantages:

- Opportunity cost: If you use all your extra funds to pay off your student loans, you might miss out on other investment opportunities that could yield higher returns.

- Lack of emergency funds: Prioritizing loan repayment might leave you with little savings for unexpected emergencies or expenses.

- Loss of tax benefits: Depending on where you live, tax benefits may be associated with student loan debt. Paying off your loans early could mean missing out on these deductions.

Discover strategies to accelerate debt repayment while considering other financial goals.

While focusing solely on paying off your student loans is tempting, balancing this goal with other financial priorities is essential. Here are some strategies that can help accelerate debt repayment while considering your broader financial goals:

- Create a budget: Analyze your income and expenses to identify areas where you can cut back and allocate more towards loan repayment.

- Prioritize high-interest loans:

Tracking Tab to House All Your Student Loan Details: Keeping Track of Your Loans Made Easy:

Organize Your Student Loan Information Effortlessly

Keeping track of your student loans is essential for staying on top of your financial responsibilities. With the Student Loan Calculator Excel, you can utilize a tracking tab to organize all your loan details in one place conveniently. This feature lets you quickly access important information such as loan balances, interest rates, and payment due dates.

Stay Informed About Your Loans

By using the tracking tab in the Student Loan Calculator Excel, you can effortlessly stay informed about your student loans. This tool enables you to monitor various aspects of your loans, including private and federal student loans. You’ll have a comprehensive overview of your loan terms and conditions.

Keep an Eye on Important Factors

The tracking tab helps you monitor crucial factors related to your student loans. It provides a clear snapshot of your loan balance, ensuring you always know how much debt you still owe. It allows you to track interest rates over time to understand how they impact the overall cost of your education.

Never Miss a Payment Due Date Again

One of the most significant advantages of utilizing the Student Loan Calculator Excel tracking tab is its ability to help you remember payment due dates. By inputting this information into the spreadsheet, it will automatically remind you when payments are coming up. This feature ensures no charge slips through the cracks, helping you avoid late fees or penalties.

Simplify Your Financial Management

Managing multiple student loans can be overwhelming, but it becomes much simpler with the tracking tab in the Student Loan Calculator Excel. You can easily see which lender each loan belongs to and keep track of all necessary borrower information. This data consolidation streamlines your financial management process and reduces the stress of keeping tabs on various loans.

Can You Pay Student Loans with a Credit Card? How Do Student Loans Impact Your Credit Score?

Paying off student loans with a credit card

Is paying off your student loans using a credit card possible? Well, the answer is both yes and no. While some loan servicers may accept credit card payments, it’s essential to consider the potential implications before going down this route.

Using a credit card to pay off your student loans can be tempting, especially if you’re looking for a way to earn rewards or take advantage of promotional offers. However, there are several factors you should keep in mind:

- Interest rates: Credit cards typically have higher interest rates than student loans. If you use a credit card, ensure the interest rate is lower than what you currently pay on your student loan.

- Balance transfer fees: Some credit cards offer balance transfer options where you can move your student loan debt onto the card. However, these transfers often come with fees, so it’s essential to calculate whether the cost outweighs any potential benefits.

- Credit utilization: Using a significant portion of your available credit limit can negatively impact your credit score. If you max out your credit card by paying off your student loans, it could harm your overall creditworthiness.

- Repayment flexibility: Unlike student loans which typically offer various repayment plans and options based on income and financial hardship, credit cards have stricter repayment terms. Failing to make minimum payments on time could lead to late fees and penalties.

While using a credit card may seem attractive at first glance, it’s crucial to carefully evaluate the pros and cons before making any decisions. Consider consulting with a financial advisor who can provide personalized guidance based on your situation.

Mastering Your Finances with the Student Loan Calculator Excel

In conclusion, mastering your finances with the Student Loan Calculator Excel can be a game-changer in managing your student loans effectively. You gain valuable insights into your loan details by understanding key concepts such as federal poverty guidelines, monthly loan costs, weighted average interest rates, and principal vs interest calculations.

Selecting the right repayment plan based on your financial goals is crucial. Utilizing income-driven repayment calculators and exploring various options will help you find the most suitable plan for your circumstances. Considering strategies like the Avalanche or Benefit-Focused Method can assist you in determining which approach aligns best with your needs.

Refinancing student loans may be an attractive option for homeowners with low-interest rates. However, it’s essential to weigh the pros and cons before deciding. Furthermore, paying off student loans early requires careful consideration of factors such as interest rates and other financial obligations.

Keeping track of your loans becomes effortless with the tracking tab provided by the Student Loan Calculator Excel. This feature simplifies organizing all relevant loan details in one place.

Lastly, understanding how student loans impact credit scores and whether they can be paid with a credit card is essential for maintaining healthy financial habits.

Take control of your financial future today by utilizing the power of the Student Loan Calculator Excel. Its user-friendly interface and comprehensive features empower you to make informed decisions about student loan management.

FAQs

How can I access the Student Loan Calculator Excel?

To access the Student Loan Calculator Excel, you can download it from reputable websites offering personal finance tools or seek assistance from financial advisors specializing in student loan management.

Can I use this calculator for private student loans?

Yes! While initially designed for federal student loans, you can adapt this calculator to estimate payments for private student loans by manually entering the relevant information.

Does using this calculator guarantee loan forgiveness?

No, the Student Loan Calculator Excel does not guarantee loan forgiveness. It serves as a tool to help you understand your loan details and explore repayment options based on your financial goals.

Can I use this calculator if I have multiple student loans?

Absolutely! The Student Loan Calculator Excel allows you to input information for multiple loans, making it easy to track and manage all your student loans in one place.

Is the Student Loan Calculator Excel compatible with Mac computers?

Yes, the Student Loan Calculator Excel is compatible with Windows and Mac computers. Ensure you install Microsoft Excel on your device to utilize its full functionality.